March 22, 2022

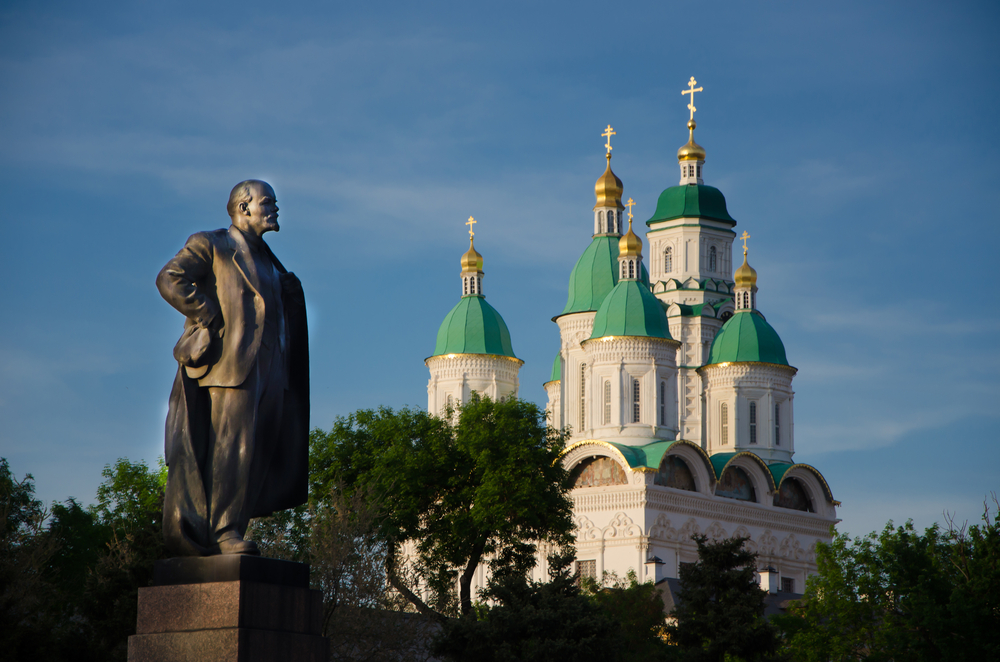

How do we determine the morality of economic sanctions?

Are economic sanctions morally permissible? That question has been asked by many people since Russia’s invasion of Ukraine and the imposition of a range of economic sanctions on Russian entities and individuals by the United States, most European nations, and many other countries. Continue Reading...