May 29, 2009

May 15, 2009

Obama and the Ideals of Catholic Social Thought

May 15, 2009

Review: Money, Greed, and God

May 13, 2009

What do our holidays mean to us?

April 20, 2009

Orthodox Christianity And Capitalism — Are They Compatible?

April 13, 2009

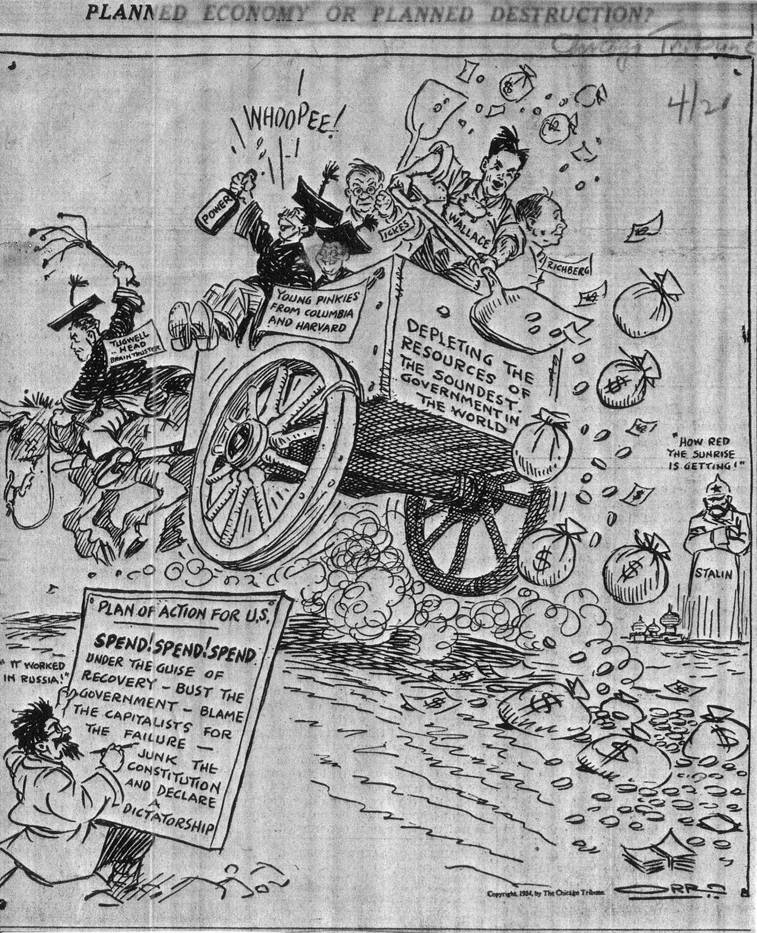

The more things change …

A 1934 cartoon by Pulitzer Prize winner Carey Orr published in the Chicago Tribune. Snopes is still checking. Continue Reading...

April 07, 2009

Fr. Z: The ‘social Magisterium’ and Acton Institute

April 03, 2009

Richard John Neuhaus the Friend

April 02, 2009

Thoughts on Higher Education, Christian and Otherwise

April 01, 2009