March 16, 2011

March 16, 2011

Surging Food Prices

March 14, 2011

Green Patriarch: No Nukes

March 14, 2011

Five Things

March 14, 2011

Can the U.S. learn from Europe’s green mistakes?

March 11, 2011

Japan Quake, Military Aid, and Shane Claiborne

March 11, 2011

Samuel Gregg: Business vs. the Market

March 11, 2011

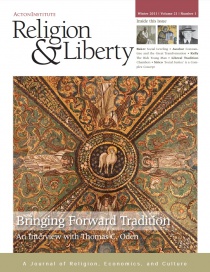

Religion & Liberty: An Interview with Thomas C. Oden

Religion & Liberty’s winter issue featuring an interview with patristics scholar Thomas C. Oden is now available online. Oden, who is a Methodist, recalls for us the great quote by Methodist founder John Wesley on the Church Fathers: “The Fathers are the most authentic commentators on Scripture, for they were nearest the fountain and were eminently endued with that Spirit by whom all Scripture was given.” Continue Reading...

March 11, 2011

Social Justice and the ‘Third California’

March 11, 2011