October 15, 2015

July 22, 2015

Obama Administration Proposes Taking Away Guns from Social Security Recipients Who Can’t Manage Their Money

July 07, 2015

Supreme Court Puts Check on EPA Overreach

June 29, 2015

Big Oil Advocacy for Carbon Taxes

May 27, 2015

Ancient Israel had 613 Regulations; Modern America has Millions

May 04, 2015

Connecting To The Internet

March 13, 2015

Apple Watch: Forbidden Fruit?

February 27, 2015

Net Neutrality News & Roundup

February 20, 2015

Does Innovation Triumph Over Regulation?

January 14, 2015

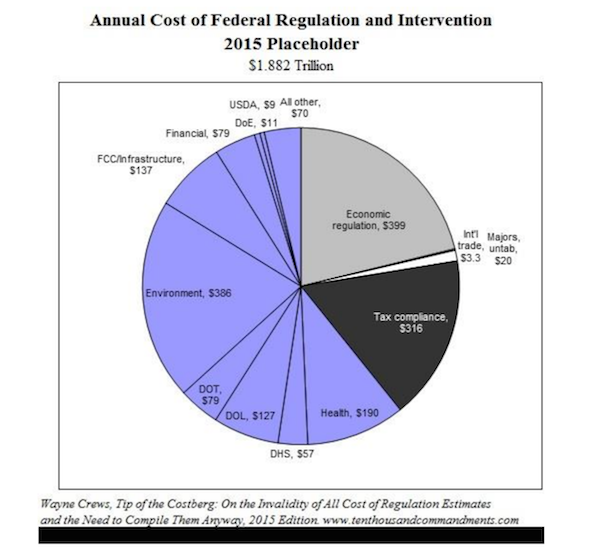

How Much Does Government Regulation Cost America?

What is the annual cost of regulations for America?

The short answer is that no one knows for sure. The officially reported regulatory costs as reported by the Office of Management and Budget (OMB) total up to $128.7 billion. Continue Reading...