March 11, 2011

Month: March 2011

March 11, 2011

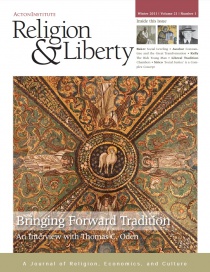

Religion & Liberty: An Interview with Thomas C. Oden

Religion & Liberty’s winter issue featuring an interview with patristics scholar Thomas C. Oden is now available online. Oden, who is a Methodist, recalls for us the great quote by Methodist founder John Wesley on the Church Fathers: “The Fathers are the most authentic commentators on Scripture, for they were nearest the fountain and were eminently endued with that Spirit by whom all Scripture was given.” Continue Reading...

March 11, 2011

Social Justice and the ‘Third California’

March 11, 2011

A Suggestion for Rounding Out ‘A Call for Intergenerational Justice’

March 11, 2011

A Discussion of ‘A Call for Intergenerational Justice’

March 10, 2011

Open Mic Night

March 10, 2011

Deficit Denial, American-Style

March 09, 2011

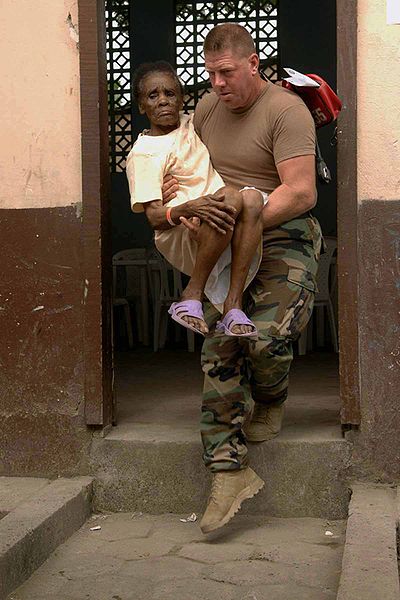

Does Shane Claiborne Care about Military Humanitarian Aid?

One of the main points of the “What Would Jesus Cut?” campaign is the pitting of defense spending against charitable social programs. The assumption is that Jesus would obviously endorse and campaign for the welfare state over the military. Continue Reading...

March 09, 2011

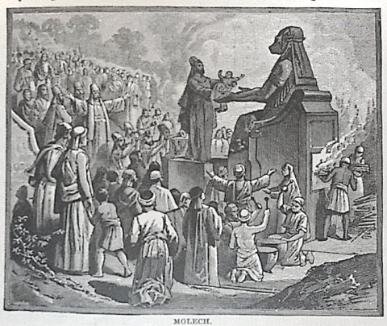

Does your 401K make you an idolator?

Here’s today’s offering from Jim Wallis’ Rediscovering Values for Lent on the Sojourners website:

Today, instead of statues, we have hedge funds, mortgage-backed securities, 401(k)s, and mutual funds. We place blind faith in the hope that the stock indexes will just keep rising and real estate prices keep climbing. Continue Reading...

March 09, 2011