March 18, 2019

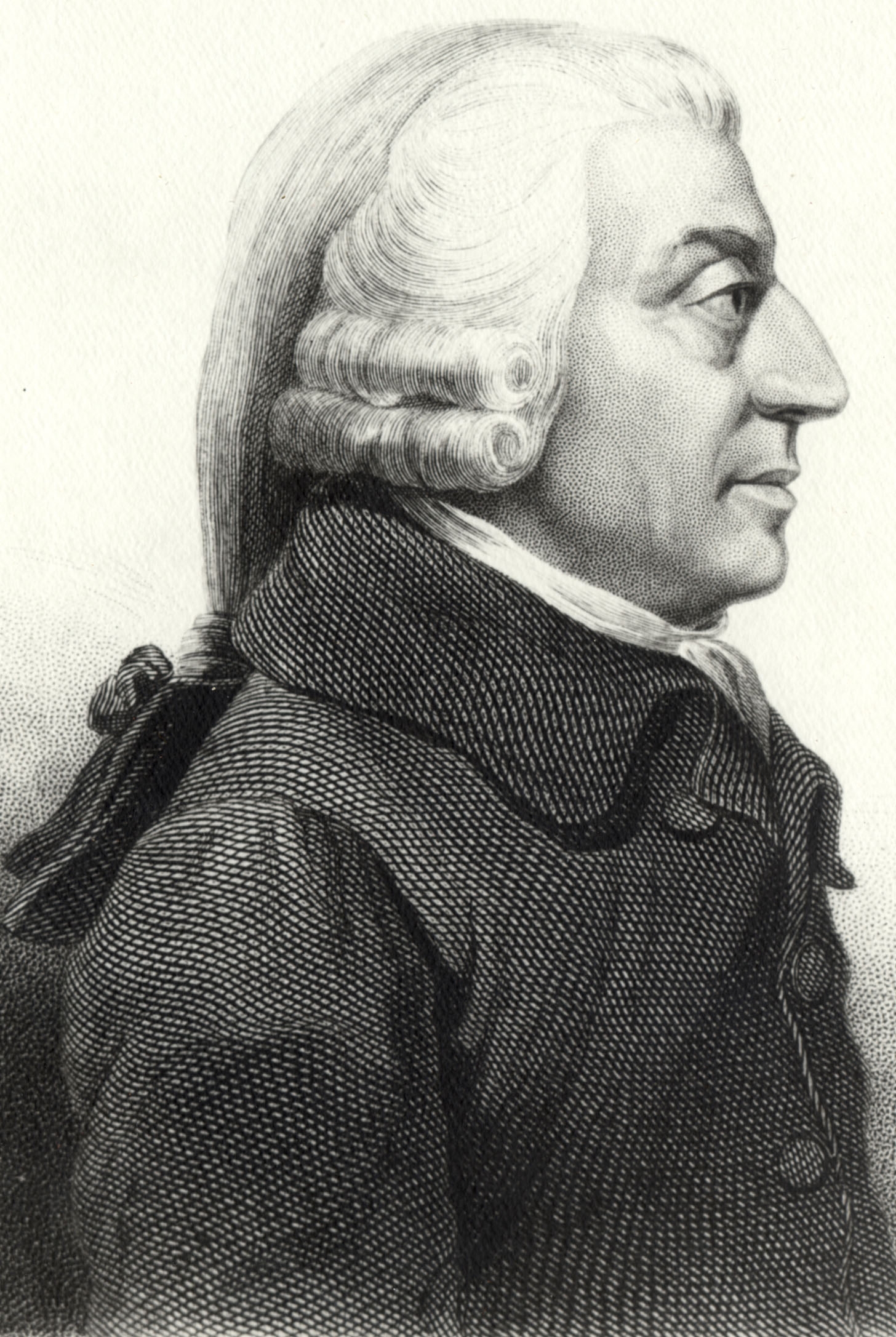

Russ Roberts on Adam Smith and the limits of economics

Russ Roberts — economist and host of the excellent EconTalk podcast — wrote a penetrating essay on what we can learn from Adam Smith’s first book, The Theory of Moral Sentiments. Continue Reading...