November 29, 2016

June 08, 2016

Samuel Gregg on banking and the common good

May 16, 2016

Audio: Samuel Gregg on God, Profit, and the Common Good

May 11, 2016

In Defense of Wall Street

October 16, 2015

Bernie Sanders Loves to Decry ‘Casino Capitalism,’ But What About Economic Freedom?

January 29, 2015

The Government Is Hungry: Detroit and ‘The Grapes of Wrath’

September 02, 2014

How Lotteries Can Help the Poor Save Money

June 12, 2014

What Christians Should Know About Money

May 06, 2014

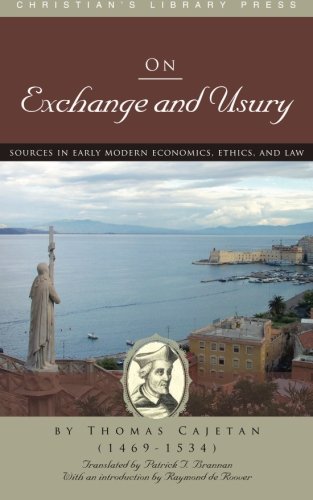

Now Available: ‘On Exchange and Usury’ by Thomas Cajetan

Christian’s Library Press has released a new translation of two treatises on exchange and usury by Thomas Cajetan (1469-1534), a Dominican theologian, philosopher, and cardinal.

Although best known for his commentaries on the Summa of Thomas Aquinas, Cajetan also wrote dozens of other works, including short treatises on socioeconomic problems. Continue Reading...

April 17, 2014