November 17, 2016

July 06, 2016

Democratic Party Platform Draft Includes $15 Minimum Wage

May 17, 2016

The Regulatory State Adds ‘Ten Thousand Commandments’ Every Year

April 22, 2016

Ben Sasse on the Path to Ordered Liberty

September 24, 2015

Video: Kishore Jayabalan On Pope Francis’ Address To Congress – France 24

June 15, 2015

Rev. Sirico: Environmental Encyclical May Fall Prey To Politics

May 01, 2015

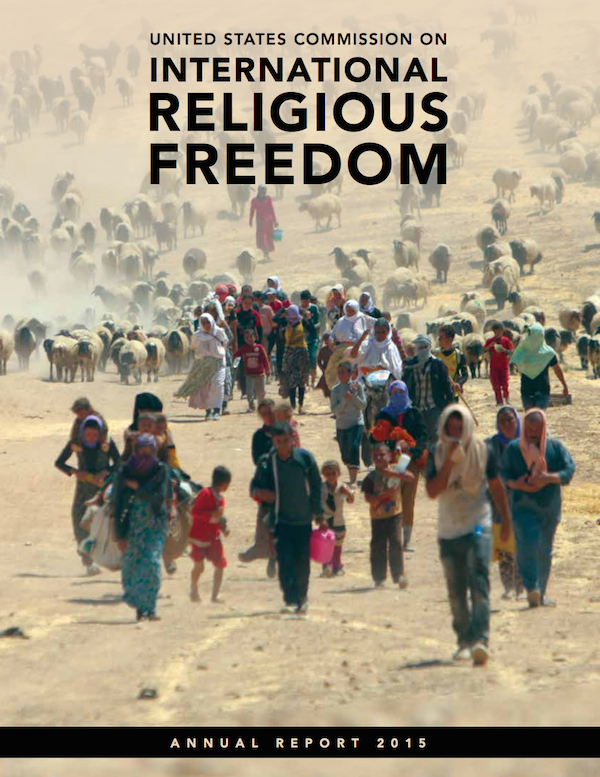

Why Religious Liberty Should Be a Foreign Policy Priority

The U.S. Commission on International Religious Freedom (USCIRF) has issued its 2015 annual report on religious liberty around the world. In their report, the USCIRF documents religious freedom abuses and violations in 33 countries and makes county-specific policy recommendations for U.S. Continue Reading...

April 13, 2015

Just Render Unto Caesar Already: The IRS and Frivolous Tax Arguments

March 12, 2015

Abraham Kuyper on ECT

July 21, 2014