April 29, 2011

March 30, 2011

Acton Commentary: Debt and the Birth Dearth

March 29, 2011

Amity Shlaes on Thrift and Calvin Coolidge

March 11, 2011

A Discussion of ‘A Call for Intergenerational Justice’

March 10, 2011

Open Mic Night

March 09, 2011

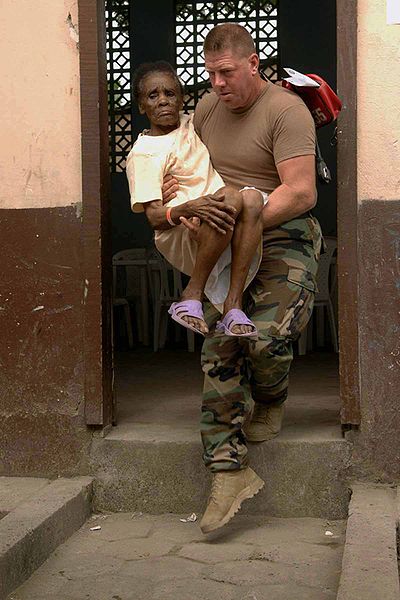

Does Shane Claiborne Care about Military Humanitarian Aid?

One of the main points of the “What Would Jesus Cut?” campaign is the pitting of defense spending against charitable social programs. The assumption is that Jesus would obviously endorse and campaign for the welfare state over the military. Continue Reading...

March 07, 2011

Shane Claiborne’s Budget Babbling

March 07, 2011

Opposing Views: America’s Debt Crisis and ‘A Call for Intergenerational Justice’

February 21, 2011

Finding Morality in the Federal Budget

November 03, 2010