October 13, 2014

May 08, 2014

Deirdre McCloskey on Ethics and Rhetoric in the ‘Great Enrichment’

May 06, 2014

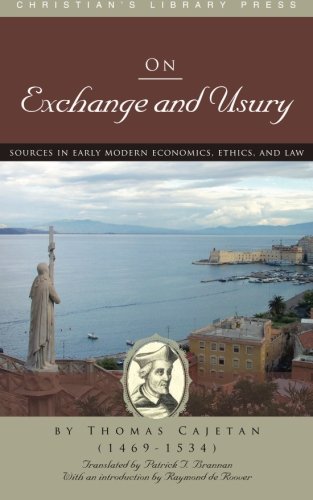

Now Available: ‘On Exchange and Usury’ by Thomas Cajetan

Christian’s Library Press has released a new translation of two treatises on exchange and usury by Thomas Cajetan (1469-1534), a Dominican theologian, philosopher, and cardinal.

Although best known for his commentaries on the Summa of Thomas Aquinas, Cajetan also wrote dozens of other works, including short treatises on socioeconomic problems. Continue Reading...

October 19, 2012

ResearchLinks – 10.19.12

October 26, 2011

Rev. Sirico: The Vatican’s Monetary Wisdom

September 01, 2011

How to Deliver a Recession: Cut Brake Lines, Accelerate Toward Cliff

September 08, 2010