June 13, 2014

June 13, 2014

David Brat on Christianity and Capitalism

June 12, 2014

What Christians Should Know About Money

June 10, 2014

Unemployment is a Spiritual Problem

June 09, 2014

John Nash: A Beautiful Austrian Mind?

June 06, 2014

Thinking Biblically About Bankruptcy

June 05, 2014

What Christians Should Know About Unemployment

May 30, 2014

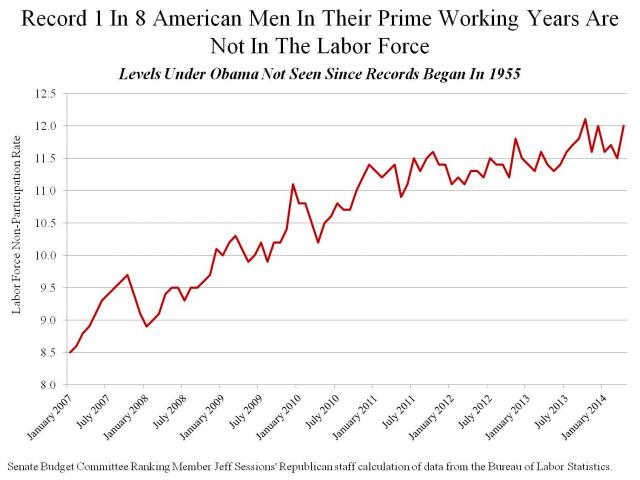

America’s Most Overlooked Economic Tragedy

Because jobs can serve the needs of our neighbors and lead to human flourishing both for the individual and communities, they are the most important part of a morally functioning economy. Continue Reading...

May 28, 2014

‘Timothy Geithner is a Moral Hazard’

May 23, 2014