October 07, 2015

September 30, 2015

How ‘Buy-One, Give-One’ Models Can Dilute Charity and Hurt Local Economies

September 23, 2015

What Pope Francis Misses About the Morality of Capitalism

July 31, 2015

Retrenchment, Revision, and Renewal: 3 Futures for Evangelicalism in America

June 11, 2015

Isolation and Self-Sufficiency: The Logical Ends of Protectionism

May 19, 2015

Samuel Gregg On Free Trade, Trans-Pacific Partnership And The Church

March 27, 2015

The Smile Curve and the Future of the Middle Class

February 18, 2015

How U.S. Farm Subsidies Hurt the Global Poor

September 12, 2014

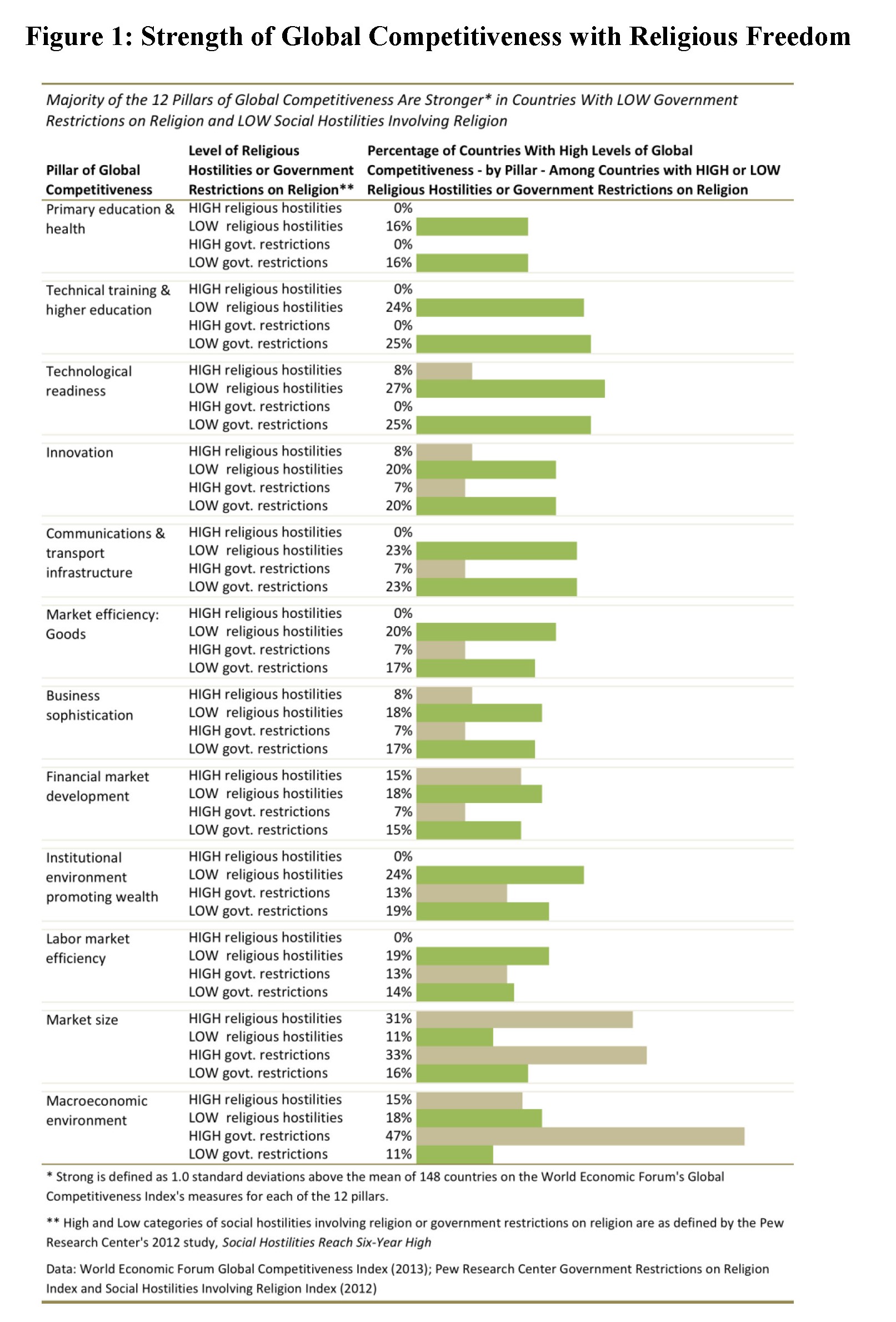

Is Religious Freedom Good for Economic Growth?

In the United States, we’ve only begun to see how impediments to religious liberty can harm and hinder certain businesses and entrepreneurial efforts. Elsewhere, however, particularly in the developing world, religious restrictions and hostilities have long been a barrier to economic growth. Continue Reading...

August 27, 2014