July 22, 2021

The crumbling façade of Cuban communism

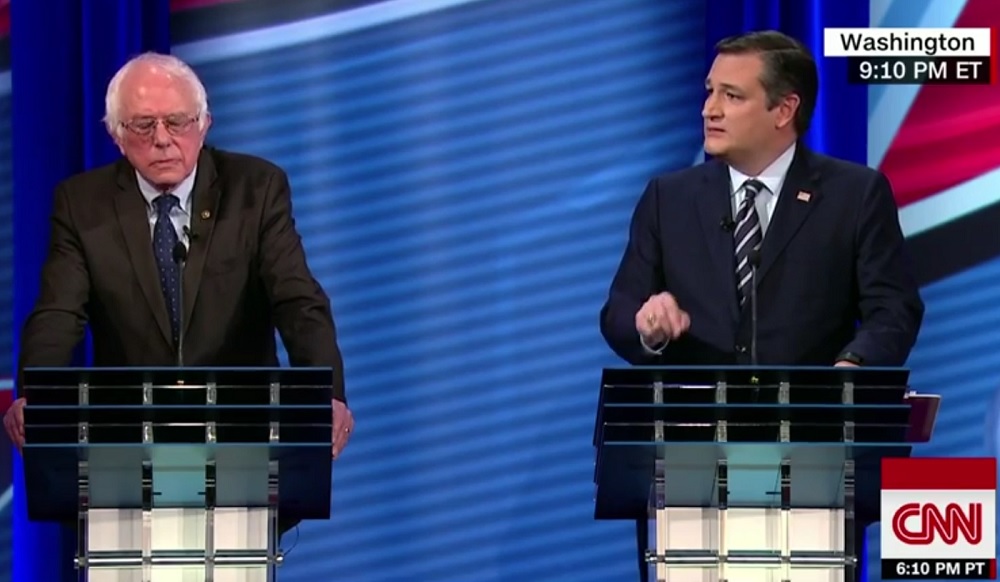

It has become routine for Bernie Sanders and other self-described democratic socialists to praise Cuba for its high literacy rates and universal health care. More recently, Black Lives Matter released a statement supporting the communist regime while criticizing U.S. Continue Reading...