July 22, 2019

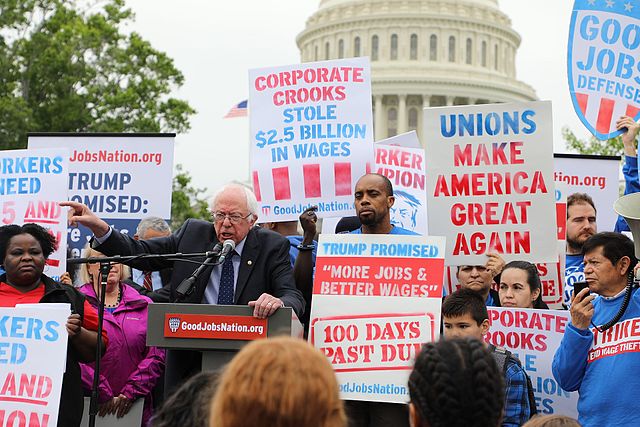

Bernie Sanders: The apologist for inequality

Since Bernie Sanders announced his candidacy for president in the 2020 election, he has brought a seemingly disastrous and looming problem to the attention of the American people, much like he did in his 2016 run: income inequality accompanied by the tyrannical rule of the elite 1%. Continue Reading...