August 05, 2019

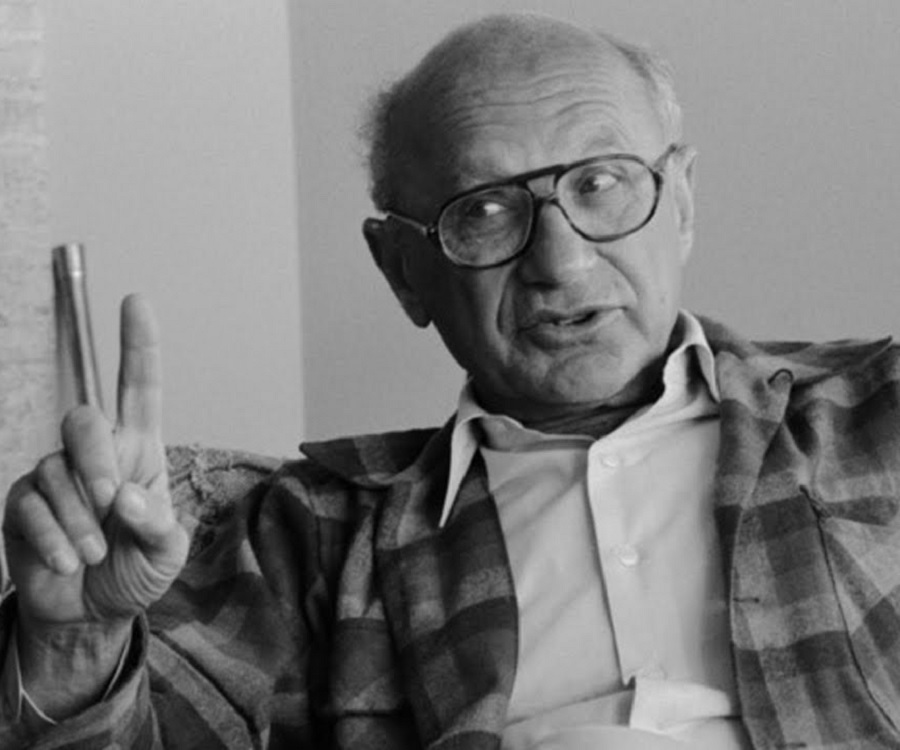

Milton Friedman on business as an enemy of enterprise

Milton Friedman is one half of the duo so often identified with “neoliberalism” (the other being Friedrich Hayek), the hegemonic power that is typically seen as constitutive of our contemporary age. Continue Reading...