December 29, 2015

March 09, 2011

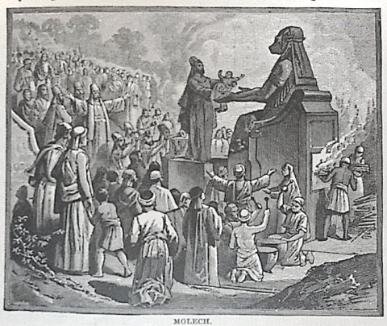

Does your 401K make you an idolator?

Here’s today’s offering from Jim Wallis’ Rediscovering Values for Lent on the Sojourners website:

Today, instead of statues, we have hedge funds, mortgage-backed securities, 401(k)s, and mutual funds. We place blind faith in the hope that the stock indexes will just keep rising and real estate prices keep climbing. Continue Reading...

January 21, 2010

Gain by Honest Industry

September 16, 2009

Government-Managed Capitalism: A Love Story

October 08, 2008