January 23, 2015

September 22, 2014

The ‘War on Poverty’ and the Unique, Unrepeatable Poor Person

Last week the U.S. Census Bureau released its report, Income and Poverty in the United States: 2013. The agency announced that “in 2013, the poverty rate declined from the previous year for the first time since 2006, while there was no statistically significant change in either the number of people living in poverty or real median household income.” Continue Reading...

August 12, 2014

Why a Basic Guaranteed Income Wouldn’t Work

July 24, 2014

In Welfare Systems, Two Plus Two May No Longer Equal Four

January 28, 2014

Actually, We Won the War on Poverty

January 13, 2014

Conservatives Should Welcome the Debate on Poverty and Income Inequality

January 08, 2014

By the Numbers: The War on Poverty

November 08, 2013

It’s Time To Rethink Food Stamps

Michael Tanner of the Cato Institute released a recent policy analysis that raises important questions about whether or not we should completely re-conceptualize how to provide food for the truly disadvantaged. Continue Reading...

November 04, 2013

Challenging the Government Monopoly on Social Welfare

August 28, 2013

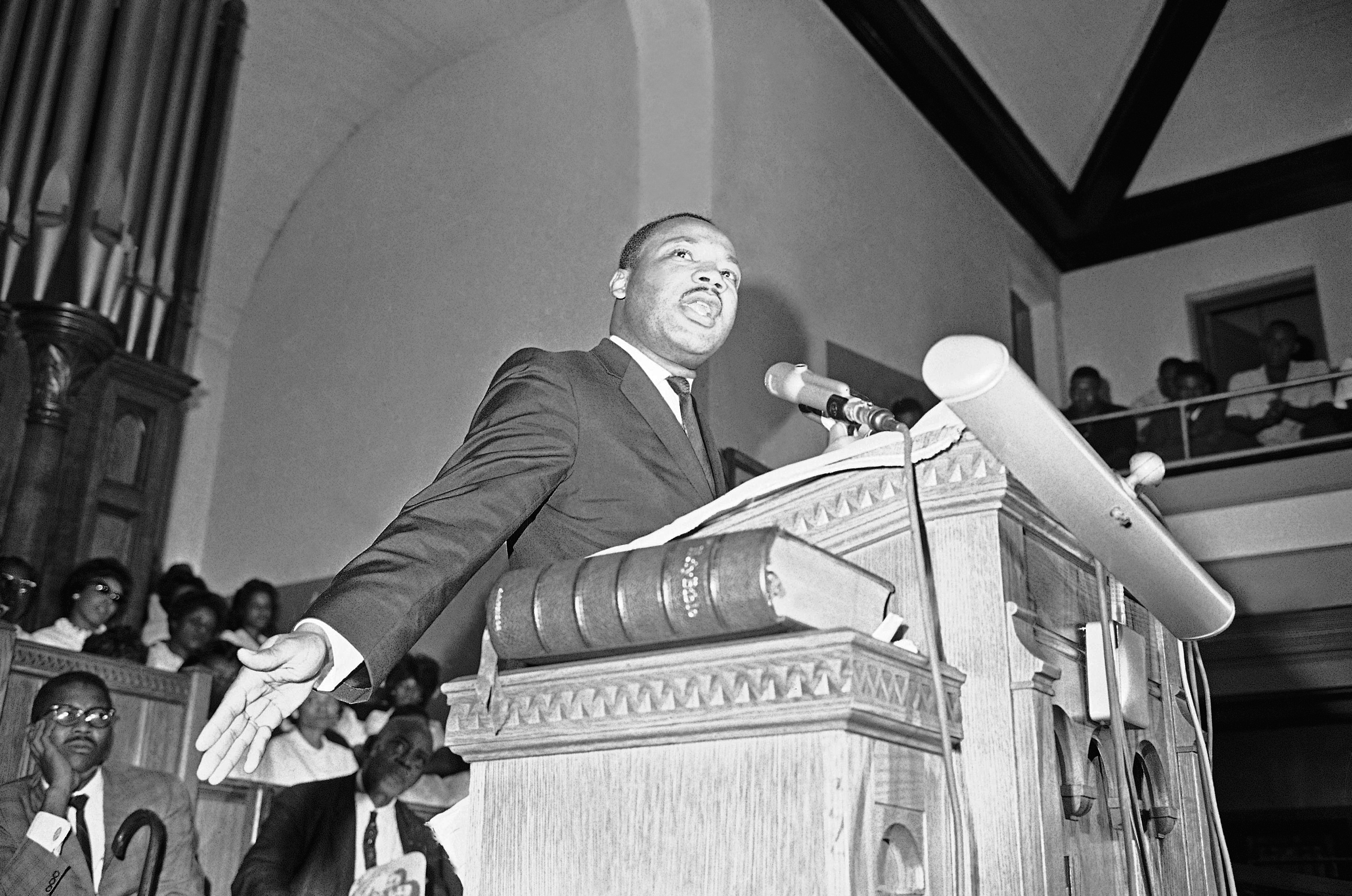

How King’s dream turned into a nightmare

In a symposium at National Review Online about where Dr. King’s dream stands, 50 years after his historic speech, Anthony Bradley writes:

Fifty years ago, Dr. King provided America with a provocative vision, in which our republic would become a place of greater political and economic liberty for African Americans. Continue Reading...