February 22, 2017

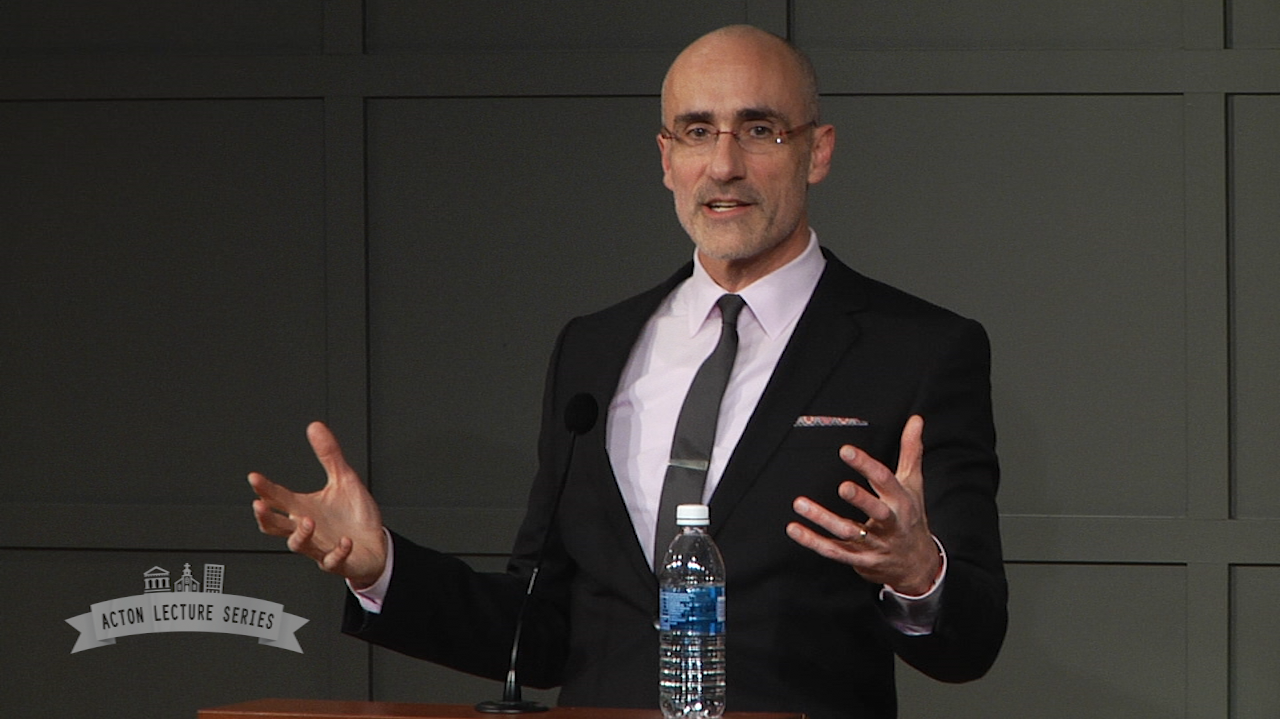

Video: Arthur C. Brooks on how to bring America together

American Enterprise Institute President Arthur C. Brooks joined us here at the Acton Institute on Monday evening as part of the Acton Lecture Series, and as usual he delivered a great and optimistic message, even in the midst of this time of deep divisions in the United States. Continue Reading...