November 23, 2016

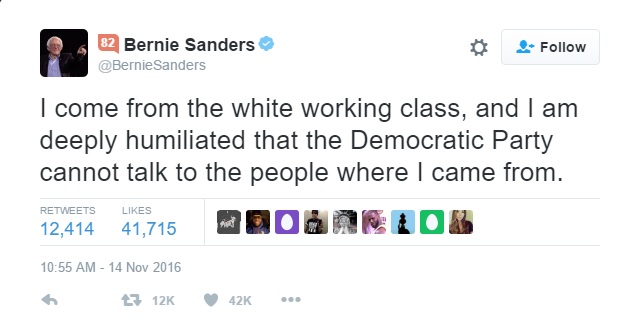

Who did Democrats forget?

In this week’s Acton Commentary I weigh in with some reflections on the US presidential results: “Naming, Blaming, and Lessons Learned from the 2016 Election.” I focus on much of the reaction on the Democratic side, which has understandably had some soul-searching to do. Continue Reading...