November 21, 2014

November 19, 2014

Radio Free Acton: Sound Money with Robert P. Murphy

November 14, 2014

Against Macho Posturing: Watering the Roots of Christian Masculinity

November 13, 2014

In Michigan, Raising The Minimum Wage Hurts The Most Vulnerable

November 12, 2014

The World’s Most Persecuted Minority

November 06, 2014

Video: Robert Murphy on The Importance of Sound Money

November 03, 2014

Audio: Ron Blue, Gerard Lameiro at the Acton Lecture Series

October 17, 2014

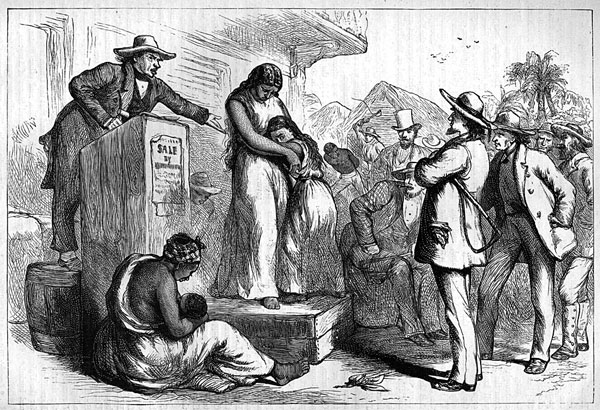

Why American slavery wasn’t capitalist

In his new book, The Half Has Never Been Told: Slavery and the Making of American Capitalism, Edward E. Baptist “offers a radical new interpretation of American history,” through which slavery laid the foundation for and “drove the evolution and modernization of the United States.” Continue Reading...

October 06, 2014

Human Smuggling Isn’t About Capitalism; It’s About Greed

October 02, 2014