October 02, 2014

September 18, 2014

Boyhood, the Masculine Spirit, and the Formative Power of Work

September 05, 2014

Stay At Home Mom? Yeah, You Don’t Count

August 27, 2014

Some Thoughts on Economic Patriotism

August 27, 2014

Which Inequality? Trends Toward Equality in Lifespans and Education

August 25, 2014

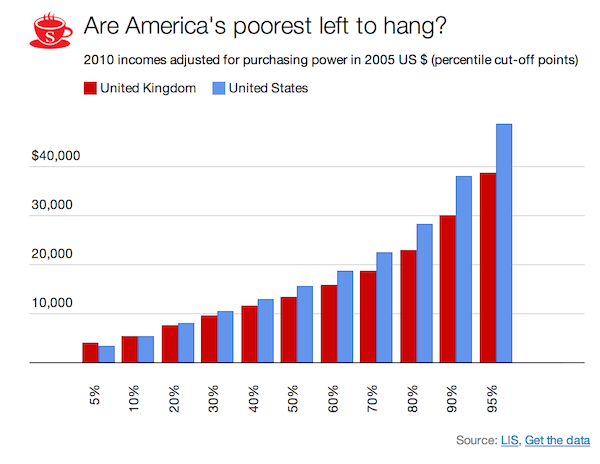

Great Britain is Poorer Than Every US State

At the height of power, circa 1922, the British Empire was the largest empire in history, covering one-fifth of the world’s population and almost a quarter of the earth’s total land area. Continue Reading...

August 20, 2014

Every Market Form in a Single Chart

August 19, 2014

Will A Sharing Economy Be A Growing Economy?

August 07, 2014

The Connection Between Inequality and Poverty Alleviation

July 31, 2014