September 15, 2016

February 10, 2015

Mike Rowe on the minimum wage: There’s no such thing as a ‘bad job’

In the latest addition to Mike Rowe’s growing catalog of pointed Facebook responses, the former Dirty Jobs host tackles a question on the minimum wage, answering a man named “Darrell Paul,” who asks:

The federal minimum wage is $7.25 and hour. Continue Reading...

January 23, 2015

America: Exceptional Or Entitled?

June 24, 2014

Coffee and Cronyism: Guess Who’s Really Paying for Starbucks ‘Free Tuition’

June 05, 2014

NYC Council to Walmart: Stop Giving Money to Our Local Charities!

May 30, 2014

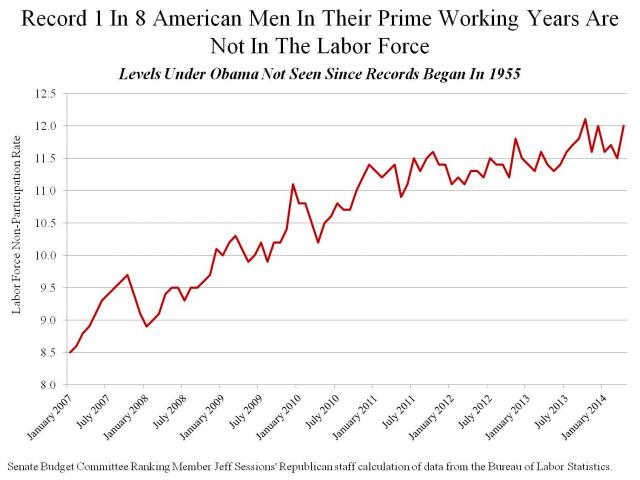

America’s Most Overlooked Economic Tragedy

Because jobs can serve the needs of our neighbors and lead to human flourishing both for the individual and communities, they are the most important part of a morally functioning economy. Continue Reading...

May 01, 2014

As Expected, Jobless Claims ‘Unexpectedly’ Increase

March 28, 2014

The Four Most Imporant Legal Questions in the Hobby Lobby Case

March 07, 2014

Explainer: What is President Obama’s Budget?

October 18, 2013