February 09, 2021

How the $15 minimum wage accelerates community decline

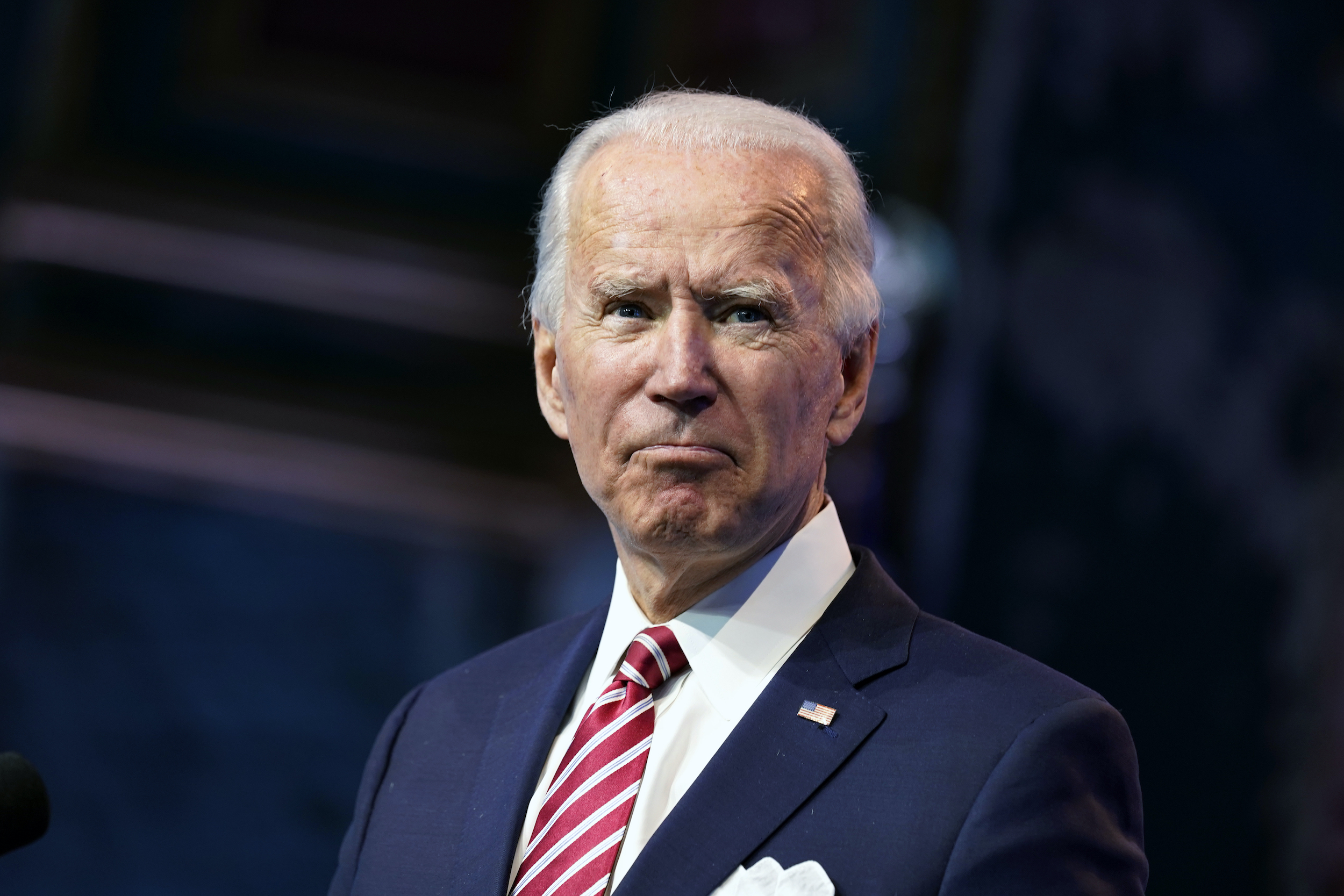

As Congress debates the specifics of yet another stimulus bill, President Joe Biden and Sen. Bernie Sanders continue to push for the inclusion a $15 federal minimum wage – a policy that is only likely to prolong pandemic pain for America’s most vulnerable businesses and workers. Continue Reading...