May 18, 2015

April 30, 2015

Why is the Episcopal Church Working as a Debt Collector?

April 15, 2015

7 Figures: Tax Day Edition

March 31, 2015

Can We End Extreme Poverty by 2030?

March 18, 2015

Explainer: What You Should Know About the Rubio-Lee Tax Plan

March 13, 2015

Apple Watch: Forbidden Fruit?

February 25, 2015

How Churches Can Protect the Poor Against Predatory Lending

February 03, 2015

Why Government Money Alone Can’t Fix Poor Schools

January 14, 2015

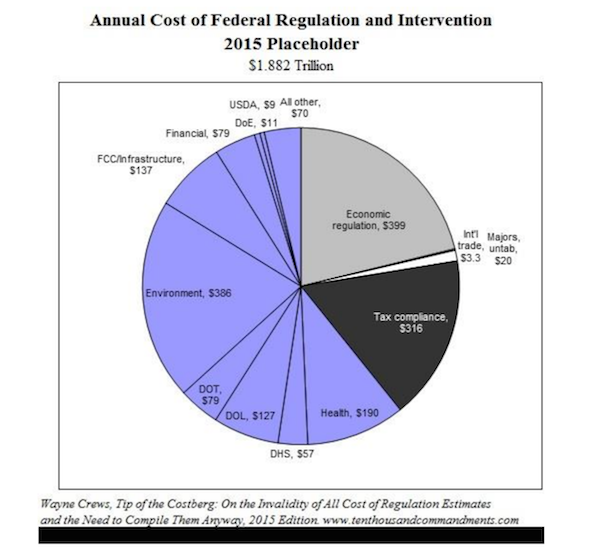

How Much Does Government Regulation Cost America?

What is the annual cost of regulations for America?

The short answer is that no one knows for sure. The officially reported regulatory costs as reported by the Office of Management and Budget (OMB) total up to $128.7 billion. Continue Reading...

January 09, 2015