April 19, 2011

April 15, 2011

Jim Wallis Drops the Sham Civility

April 14, 2011

Samuel Gregg: Christians in a Post-Welfare State World

April 03, 2011

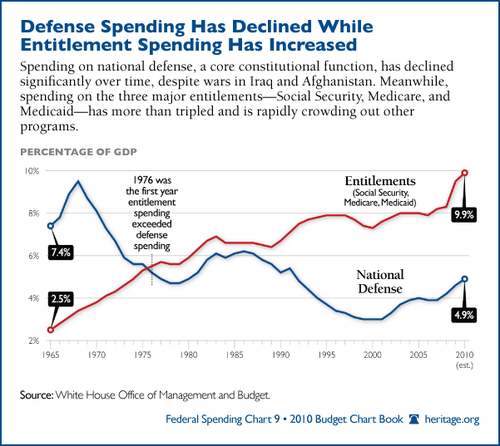

Entitlements Are Free!

March 29, 2011

WSJ cites Rev. Sirico in ‘A Requiem for Detroit’

March 10, 2011

Deficit Denial, American-Style

March 04, 2011

Taking His Name in Vain: What Would Jesus Cut?

Ray’s post pointed to something that’s been bugging me about Jim Wallis’ “What Would Jesus Cut?” campaign. As with the “What Would Jesus Drive?” campaign (“Transportation is a moral issue.” What isn’t these days?), Continue Reading...

December 15, 2010

In the ‘pressure cooker’

December 13, 2010

Samuel Gregg: Socialism and Solidarity

November 04, 2010